Adding up the VC advantage for investing in emerging clean-tech companies

Ernst & Young analysis reveals that venture capital investments in US clean-tech firms jumped by 73pc to reach US1.1bn in Q3 2011, compared with the same quarter last year. Obama’s clean-energy drive appears to be working, so where does Ireland stand with clean-tech?

Ernst & Young based its analysis on data from Dow Jones VentureSource.

As part of US President Barack Obama’s clean-energy drive, especially with October having been declared Clean Energy Month, in the US, the Department of Energy (DoE) has been getting cosy with clean-tech companies, giving loan guarantees to a plethora of clean-energy companies.

Obama, however, has come under the ring of fire, as two clean-tech companies the DoE recently backed have sought bankruptcy protection. These are:

- Solar panel manufacturer Solyndra

- Energy storage company Beacon Power Corp.

Interestingly, Irish wind energy developer Gaelectric had started collaborating with Beacon Power to progress its flywheel energy storage technology earlier this year. As part of the agreement, Gaelectric Energy Storage, the storage technology subsidiary of Gaelectric, was to start identifying opportunities for flywheel technology on the Irish grid, as well as developing flywheel-based projects.

Beacon Power and Gaelectric also jointly funded a study of the Irish electricity grid using various scenarios of future wind penetration.

Just this July, Beacon Power opened its flywheel storage plant to supply New York state with smarter, cleaner energy.

Beacon Power’s 20MW plant, which is based in Stephentown, New York, was at the time of opening, North America’s largest advanced energy storage facility. All 200 flywheels at the plant were spinning as of 22 July 2011.

At the time Beacon Power said the plant, which operates continuously, would store and return energy to the grid to provide about 10pc of New York state’s overall frequency regulation needs.

Irish clean-tech firms making their mark

Here’s a glimpse of some Irish clean-term firms that are starting to make their mark in the renewable energy space. These firms have attracted the attention of ventures capitalists.

Treemetrics – The Enterprise Ireland-supported Irish clean-tech firm TreeMetrics, led by two young former foresters (Enda Keane and Garret Mullooly), it is aiming to revolutionise the forestry industry, making it cleaner, more CO2-friendly, and ultimately helping foresters increase their bottom line, while protecting the environment as best they can. The company is also doubling its workforce to 20 in the next few months.

TreeMetrics has pioneered a unique cloud-based platform that also harnesses Google Earth, to bring foresters into the digital century using cloud computing. It has recently secured contracts with some of the planet’s most prominent state forest owners, including the British Forestry Commission, Forestry South Australia and the state forest owner in Finland – Metsahallitus.

AER Sustainable Energy – The NUIG spin-out has developed enzyme technology to convert algae into biofuel.

iKon Semiconductor – A fabless semiconductor company focused on developing innovative, highly integrated and efficient solutions for the rapidly growing LED lighting industry

REDT (Renewable Energy Dynamics Technology) – It has created a range of vanadium redox flow batteries, based on electrochemical theory that was first put into practice over 120 years ago. Vanadium redox batteries have been demonstrated in applications such as load-levelling the power generated by a wind farm, powering a house using solar energy and in a prototype electric vehicle. This tech has the potential to reduce smart-grid costs.

Wind power

A Siemens offshore wind farm

Wind-energy record in Ireland

Back in October, Ireland hit a wind-energy record, when the power generated from wind reached 1,341 megawatts (MW) – enough power to supply 870,000 homes. It was a fairly significant achievement as Ireland aims to keep apace with its climate change obligations to 2020, as well as attracting future clean-tech investors down the line.

IBM opens US$50m Smarter Cities Challenge grant program

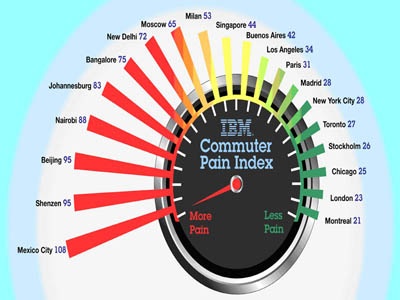

To understand consumer attitudes around traffic congestion, the IBM Commuter Pain Index, illustrated in this speedometer graphic, ranks the emotional and economic toll of commuting in 20 international cities

‘The world is now our lab’ – IBM

And just last week IBM chose Ireland (Dublin specifically) – for its new Research and Development Lab, a first for the European Union, and a centre that will house the Smarter Cities Technology Centre, with up to 200 jobs on the way.

John Kelly III, head of Research and senior vice-president and director of IBM Research, was in Dublin for the opening of the centre.

“We’re opening a very special IBM centre,” he said. “It’s the only R&D combined centre in the EU …

“Our new Ireland lab exemplifies IBM Research’s strategy of making the world our lab by focusing its mission on smarter cities and high-performance computing, working closely with leading scientists and engineers from academia, government, and commercial entities, and accelerating impact through the combination of research and development,” said Kelly at the time.

Via smart tech, especially green tech, IBM is aiming to change the way we predict everything, from future natural disasters, to how we choose the ideal place to live to suit our personal needs – be it childcare, away from high-crime levels, to the towns with the best ethnic restaurants.

Back to the E&Y research on US clean-tech VC

The E&Y report examined 76 companies vested in renewable power and energy efficiency which received VC funding, as compared to only 36 in 2010.

Key points:

- On a consecutive quarter basis, dollars invested in the third quarter were 4pc higher than the second-quarter amount.

- The energy storage sector scored the best, raising US$421m in Q3 and posting a 1,932pc increase over the same period in 2010.

- Many companies were in the commercialisation phase, a reflection of how they are approaching industry maturity.

- Energy storage, Energy/Electricity Generation and Energy Efficiency, with the Energy/Electricity Generation (composed of clean-tech firms deploying solar, wind and geothermal) raised the second largest amount of VC capital, getting US$255.1m. Solar energy performed best, garnering 77pc of the investments, or US$195.8m.

“Confidence in clean-tech investing continues despite the challenging investment market. We saw significant commitments in energy storage, which reflects a growing corporate focus on proactively managing their energy mix,” said Ernst & Young’s Jay Spencer, announcing the findings on 2 November 2011.

2010 clean-tech VC (E&Y research)

US venture capital (VC) investment in clean-tech companies in Q2 2010 hit $1.5bn in 68 financing rounds, a 63.8pc increase in capital and an 4.6pc increase in deals compared to Q2 2009, according to the Ernst & Young LLP analysis based on data from Dow Jones VentureSource. This was the highest level of venture funding for cleantech since Q3 2008.

Later stage venture financings were the main driver of investment growth in Q2 2010 with US$891. 2m invested in 33 deals.

Compared to Q2 2009, later stage activity rose 83.3pc in terms of deals and 143pc in terms of dollars. In all, later stage financings accounted for 59pc of total funding in the quarter.

Automotive, solar and biofuels were the main focus of the top deals. The top 10 deals also included two large second rounds.

The electrification of transportation

Q2 2010 was marked by financing activity in the automotive industry. Deals in this space included the US$350m second round investment in Better Place, a Palo Alto-based provider of electric vehicle (EV) support infrastructure.

Additionally, Fisker Automotive Inc., of Irvine, CA, a plug-in hybrid EV manufacturer, raised $35m and Eco Motors, a manufacturer of diesel engines that are fuel efficient and lower emissions, from Troy, MI, raised $23.5m

On 8 July 2010, President Obama’s made a speech at Smith Electric Vehicles factory in Kansas City, MO, where he announced that the US share of the world market for advanced batteries for electric and hybrid vehicles could grow by 20pc, up to 40pc of the world’s market, by 2015.