Ireland is above average for mobile broadband, according to the European Commission, but growth in fixed-broadband penetration is slowing down and the country is below the European average. Across Europe, there are concerns about IT skills and the realisation that e-commerce and R&D growth has stalled.

According to the European Commission’s digital agenda scoreboard, average mobile broadband penetration in Ireland is 60pc.

The growth in fixed broadband penetration is slowing down, leaving the penetration (24.3pc) below the EU average (Ireland ranks 17 out of 27).

DSL remains the most common broadband technology but the share of non-DSL broadband lines has increased with most of the growth coming from cable broadband.

One reason for that is the price for the so-called ‘local loop’. The prices other licensed operators have to pay to access the local loop are still among the highest in the EU.

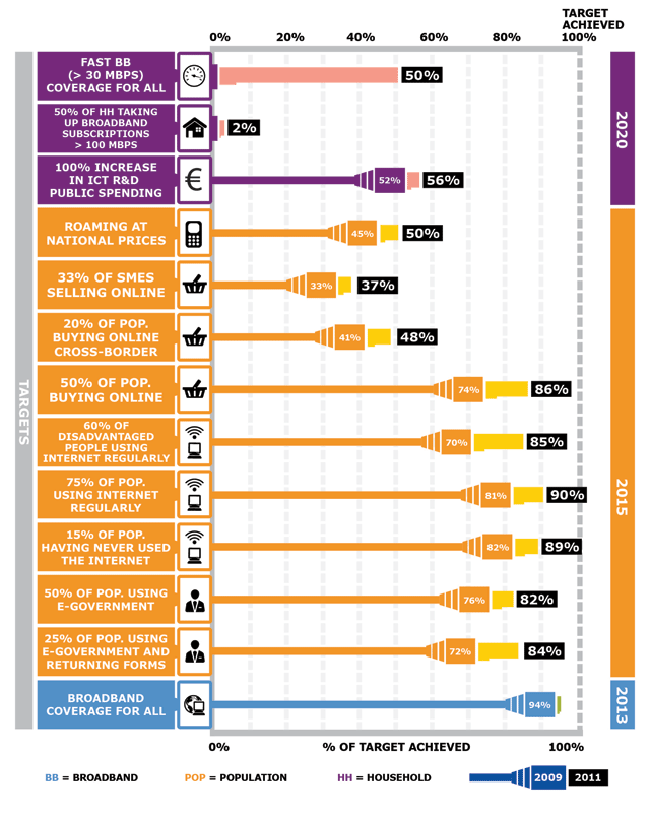

The European Commission report also claims telecoms companies continue to rip off consumers with mobile roaming prices. In 2011-2012, more companies broke ranks with rip-off approaches, by offering price bundles or roaming rates that mirror national rates. However, consumers still pay an average of three and a half times as much for roaming calls as for national calls.

“Europeans are hungry for digital technologies and more digital choices, but governments and industry are not keeping up with them,” said European Commission vice-president Neelie Kroes.

“This attachment to 20th-century policy mindsets and business models is hurting Europe’s economy. It’s a terrible shame. We are shooting ourselves in the foot by under-investing. Europe will be flattened by its global competitors if we continue to be complacent.”

A league Ireland actually does lead

Interestingly, Ireland is leading the EU in the field of e-government. Making more public services available online is seen as a means to help maintain quality and underlines the valuable role of e-government in successful structural reform.

The most significant trends in the EU’s ICT sector are greater data consumption and a shift to mobile technologies, like smartphones and mobile services, which now account for 8m jobs and 6pc of EU GDP.

However, although there is strong digital demand in Europe, this potential is undermined by failure to supply enough fast internet, online content, research and relevant skills.

The connected State(s) of Europe

Across Europe, the report claims, broadband is nearly ubiquitous and 95pc of Europeans have access to a fixed broadband connection. Consumers and businesses are moving fast to mobile. Mobile internet take-up grew by 62pc to 217m mobile broadband subscriptions.

Some 15m Europeans connected for the first time in 2011, with now 68pc of Europeans online regularly and 170m on social networks.

However, half the European labour force does not have sufficient ICT skills to help them change or find a new job.

While 43pc of the EU population has medium or high internet skills and can, for example, use the internet to make a phone call or create a web page, nearly half of the labour force is not confident their computer and internet skills are sufficient in this labour market. Almost 25pc have no ICT skills. These problems are making it difficult to fill ICT vacancies which will number 700,000 by 2015.

Barriers to e-commerce

Online shopping is still a national activity. While 58pc of EU internet users are shopping online, only one in 10 have purchased from a website based in another EU member state. Language barriers and red tape (such as refusal to deliver and copyright complications) are the biggest problems.

Use of e-commerce by SMEs has stalled. The majority of SMEs neither shop nor sell online, limiting their export and revenue potential.

Research investments are falling further behind our competitors. While public research has been protected from austerity measures – spending is well below the 6pc annual growth needed to double public investment by 2020. Commercial research investments are falling. The EU ICT sector now has less than half the R&D intensity of the US ICT sector.