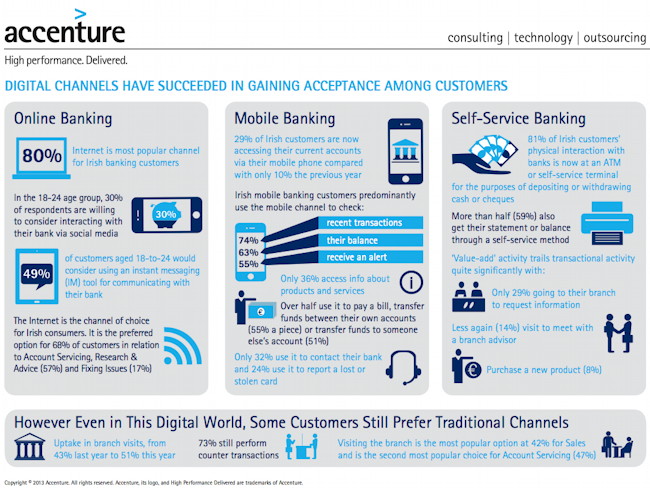

The use of mobile banking has increased among Irish consumers, with 29pc of them now accessing their current accounts via their mobile phone compared to only 10pc in 2012, a survey by Accenture suggests.

The internet is the most popular channel for Irish banking customers at 80pc, while only 11pc of consumers use the telephone to conduct their banking.

Management consulting, technology services and outsourcing company Accenture commissioned the digital banking online survey of 4,009 current account customers across Ireland and the UK. The annual Current Account Customer Survey includes 630 respondents from the Republic of Ireland.

The survey findings also reveal Irish mobile banking customers predominantly use this channel to check their recent transactions (74pc) check their balance (63pc) or receive an alert (55pc).

When it comes to transactional activity, more than half use it to pay a bill, transfer funds between their own accounts (55pc apiece) or transfer funds to someone else’s account (51pc).

Only about one-third (32pc) use it to contact their bank and 24pc use it to report a lost or stolen card.

Channel of choice

Andrew Desmond, head of financial services at Accenture Ireland, said the internet has cemented its position as the channel of choice for Irish banking customers and in the last year mobile is also gaining pace.

“As the changing Irish consumer integrates technology into their everyday life, the customer experience is also impacted and this presents a major opportunity for Irish companies to give consumers what they want, while controlling their cost base,” Desmond said.

“In fact, findings from Accenture’s Consumer Pulse study revealed that two-thirds of Irish consumers say technology has improved their service experience in the past five years.”

Desmond added that banks’ success in rolling out effective, user-friendly digital channels may be contributing to a more distant relationship between institutions and their customers, which impacts their opportunities to sell and build loyalty.

“The challenge now is to re-engage customers through digital channels by personalising interaction using big data and analytics to tailor a multi-channel experience,” he said. “They should also look at ways in which so-called basic principles of good service – such as speed and efficiency, and rewarding loyalty – translate to the digital world.”

Mobile banking image via Shutterstock