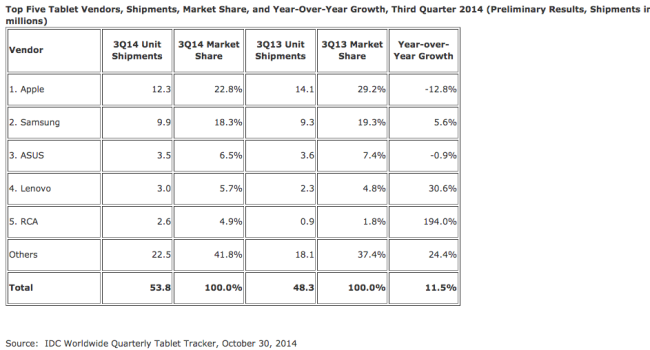

More than 53.8m tablet computers were sold across the globe in the third quarter of 2014, according to IDC, up 11.5pc on the same time last year.

The increased sales were driven by back-to-school promotions and the US appetite for connected devices.

“Not only is the US market one of the largest for tablets, but third quarter results also indicate that this is where the growth is,” said Jean Philippe Bouchard, IDC Research Director for Tablets.

“We saw Verizon continuing to sell connected tablets at a fast pace, a strategy that we believe other carriers will replicate in following quarters.

“We also saw RCA enter the top 5, impacting the entire US market and worldwide ranking with one large deal linked to back-to-school and channel fill ahead of Black Friday. Those two elements resulted in the US tablet market growing at 18.5pc year-over-year compared to the worldwide market growing at 11.5pc annually.”

Despite broadest iPad line-up, IDC still expects 2014 to be the year of the iPhone

Despite a continued shipment decline for its iPad product line, Apple maintained its lead in the worldwide tablet market, shipping 12.3 million units in the third quarter. Although Apple has recently updated and expanded its iPad lineup to its widest offering ever, IDC still expects 2014 to be the year of the iPhone.

Samsung held its number two position on the market with 9.9 million units shipped, capturing an 18.3pc market share in the third quarter. The company has begun to focus on the North American tablet market and the Middle East and Africa where low-cost Asian competitors haven’t yet gained a foothold.

Lenovo’s strength in emerging markets has been paying off as they experienced greater than 30pc growth and have been able to increase their share by almost a percentage point. Lenovo has also had the benefit of leveraging its brand and strength in the PC business to secure a strong position in the tablet market.

“Although the low-cost vendors are moving a lot of volume, the top vendors, like Apple, continue to rake in the dollars,” said Jitesh Ubrani, senior research analyst, Worldwide Quarterly Tablet Tracker.

“A sub-US$100 tablet simply isn’t sustainable—Apple knows this—and it’s likely the reason they aren’t concerned with market share erosion,” said Ubrani.