The iPhone 4S

There has been an unprecedented wave of advance demand for the next-generation Apple iPhone, the so-called iPhone 5. This is despite significant momentum behind the latest Samsung Galaxy S III smartphone.

ChangeWave Research’s study of more than 4,000 North American consumers forecasts Apple arriving in pole position in Q4.

“Advance demand for the ‘iPhone 5’ is strikingly higher than we’ve seen for any previous iPhone model,” said Dr Paul Carton, ChangeWave’s VP of Research.

“Overall smartphone sales should spike to an all-time high this fall, and of course Apple is going to be the No 1 beneficiary. But besides Apple, and to a lesser degree Samsung, no other manufacturer is likely to benefit from this coming wave of demand.”

Samsung (19pc) is showing major momentum for the second time in the past three surveys – having registered a 6-point surge in planned buying just since March. All told, this represents nearly a four-fold increase in consumer intent to buy Samsung smartphones in the past three quarters.

A total of 2pc of respondents say they’re very likely to buy a Samsung Galaxy S III and 7pc somewhat likely. The top reason why they plan on buying is the size and quality of screen (15pc).

New features in the iPhone 5 will likely include a larger screen, improved camera, a new iOS 6 operating system and 4G/LTE capability. The iPhone 5 is expected to cost US$199 for the 16GB model, US$299 for the 32GB model and US$399 for the 64GB model, with a two-year contract on most of the major carriers.

Higher demand for ‘iPhone 5’ than any other previous iPhone model

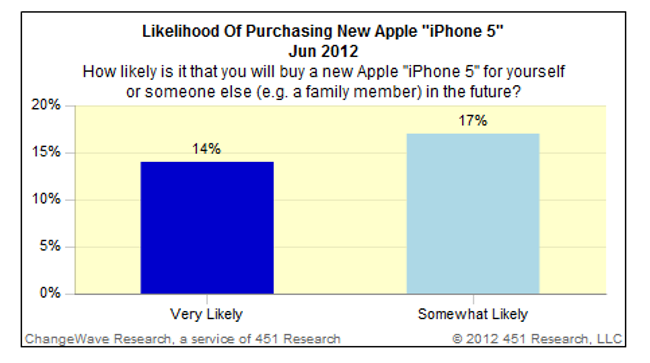

With 14pc of consumers saying they’re very likely and 17pc somewhat likely to buy the ‘iPhone 5’ in the future, advance demand for the next iPhone is strikingly higher than for any previous iPhone model.

For example, a similar question on future demand for the iPhone 4S, taken at the time of its October 2011 launch, showed 10pc very likely and 11.5pc somewhat likely to purchase the device. Moreover, the iPhone 4S is currently considered the most successful smartphone release in history. In contrast to Apple and Samsung, demand for Motorola (4pc; down 2 points) and HTC (3pc; unchanged) remains sluggish, while RIM (2pc; unchanged) is stuck at its all-time low.

In a positive finding for Nokia (2pc), it’s seeing a slight uptick in consumer smartphone buying. While it’s only a 1 point increase over March, it remains a hopeful sign for its new Lumia device, as well as its strategic partnership with Microsoft.