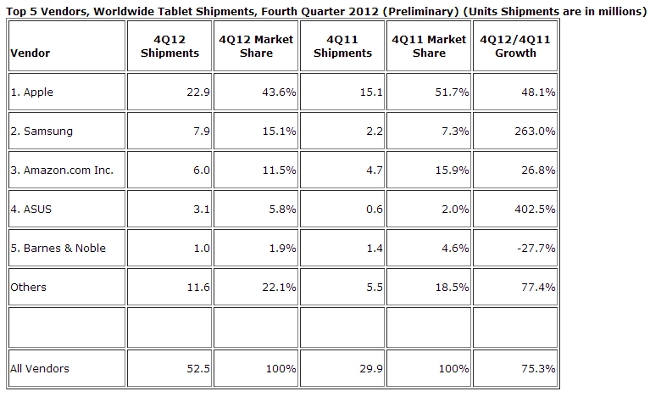

The fourth quarter of 2012 was a record one for tablets, with 52.5m units shipped worldwide, but Apple’s market share is dropping while Microsoft is struggling to become a contender, according to preliminary data from IDC’s Worldwide Quarterly Tablet Tracker.

Overall, the tablet market saw higher-than-expected growth in Q4 2012, up 74.3pc from the previous quarter and 75.3pc year-on-year. IDC credits this growth to lower prices for consumers, the widening range of options available and increased holiday spending.

The record-breaking growth of the tablet market is in stark contrast to the trends of the PC market, which recorded its first decline in shipments in more than five years in Q4 2012.

Increased competition

But despite increasing tablet shipments overall, Apple saw its market share decline for the second quarter in a row as competitors stepped up their game. However, the iPad maker is still on top by a long shot, having shipped 22.9m units in Q4 2012 to claim 43.6pc of the market.

Samsung is a distant second with 15.1pc of the share, but the brand experienced a massive 263pc year-on-year growth. The 8m Samsung tablets shipped in Q4 2012 were a combination of Android and Windows 8 devices and this multi-platform approach appears to be working for the South Korean manufacturer.

Amazon takes third place with 11.5pc of the market, which equates to more than 6m units. This is a slight jump from its Q3 share of 8.3pc as its low-cost tablets are popular Christmas gifts.

Asus, manufacturer of Google’s Nexus 7, saw its share slip two percentage points to 5.8pc, though the brand also recorded the highest year-on-year increase of 402.5pc.

And fifth in line is Barnes & Noble, purveyors of the Nook, who shipped close to 1m units to claim 1.9pc of the market.

Source: IDC Worldwide Quarterly Tablet Tracker, 31 January 2013 (preliminary data)

Microsoft’s challenge

Having shipped less than 900,000 units, Microsoft didn’t make it to the top 5 and Ryan Reith, mobile device trackers programme manager at IDC, believes the brand needs to adapt to fit in. “There is no question that Microsoft is in this tablet race to compete for the long haul. However, devices based upon its new Windows 8 and Windows RT operating systems failed to gain much ground during their launch quarter, and reaction to the company’s Surface with Windows RT tablet was muted at best,” said Reith.

“We believe that Microsoft and its partners need to quickly adjust to the market realities of smaller screens and lower prices. In the long run, consumers may grow to believe that high-end computing tablets with desktop operating systems are worth a higher premium than other tablets but, until then, [average sales prices] on Windows 8 and Windows RT devices need to come down to drive higher volumes.”

Tablet user image via Shutterstock