The new Apple iPad

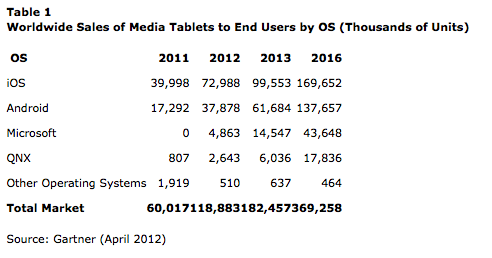

Worldwide sales of tablet computers will reach 118.9m units this year, up 98pc on 2011 when 60m units were sold. Apple’s iOS operating system dominates, with sales of iPad devices accounting for 61.4pc of global tablet sales.

Gartner says that despite the arrival of Microsoft-based devices to this market, and the expected international rollout of the Kindle Fire, Apple will continue to be the market leader up until 2015. By 2015, enterprises will account for 35pc of the market for tablet devices.

“Despite PC vendors and phone manufacturers wanting a piece of the pie and launching themselves into the media tablet market, so far, we have seen very limited success outside of Apple with its iPad,” said Carolina Milanesi, research vice-president at Gartner.

“As vendors struggled to compete on price and differentiate enough on either the hardware or ecosystem, inventories were built and only 60m units actually reached the hands of consumers across the world. The situation has not improved in early 2012, when the arrival of the new iPad has reset the benchmark for the product to beat.

“It appears that this year competitors have waited to see what Apple would bring out – because there were very few announcements of new media tablets at either the Consumer Electronics Show or Mobile World Congress.

“Many vendors will wait for Windows 8 to be ready and will try to enter the market with a dual-platform approach, hoping that the Microsoft brand could help them in both the enterprise and consumer markets,” Milanesi said.

Heralding the arrival of the Microsoft Windows 8 tablet

Microsoft tablets are projected to account for 4.1pc of media tablet sales this year, and grow to 11.8pc of sales by the end of 2016. Windows 8 is Microsoft’s official entrance into the media tablet market.

“IT departments will see Windows 8 as the opportunity to deploy tablets on an OS that is familiar to them and with devices offered by many enterprise-class suppliers,” Milanesi said.

“This means that we see Windows 8 as a strong IT-supplied offering more so than an OS with a strong consumer appeal.”

Gartner analysts said enterprise sales of media tablets will account for about 35pc of total tablet sales sold in 2015.

These sales will not be clearly defined as enterprise purchases. Gartner expects enterprises to allow tablets as part of their buy-your-own-device (BYOD) programme. More of these tablets will be owned by consumers who use them at work.

“This poses a big threat to vendors that thought about focusing on the enterprise market who will now have to become appealing to consumers, as well,” Milanesi said.

Tablet trend replicates smartphone experience

“This is exactly the same trend that vendors such as RIM had to face in the smartphone market. The difference here is that tablets have been created for consumers first and then relied on an ecosystem of apps and services that make them more manageable in the enterprise,” Milanesi continued.

“When the deployment will come from the IT department we believe that operating systems such as Windows 8 will have an advantage as long as they are not seen as a compromise in usability for the users.”

Android tablets are forecast to account for 31.9pc of media tablet sales in 2012. Gartner analysts said the main issue with Android tablets has been the lack of applications that are dedicated to tablets and therefore take advantage of their capabilities.

Gartner’s consumer survey data shows that consumers are running many of their apps on their mobile phones and their tablets.