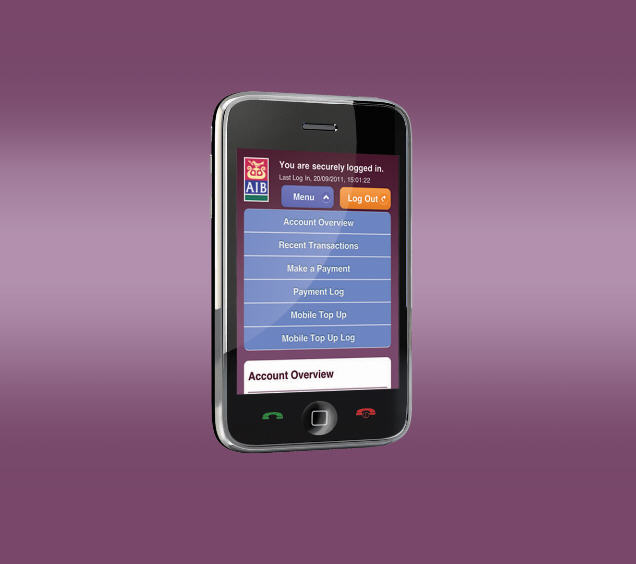

AIB will today unveil a new mobile banking service that will allow its customers to check balances, pay bills, top up mobile credit and transfer funds to other accounts.

The new mobile banking channel will begin today as a web page optimised specifically for smartphones and will be followed in the coming weeks by an Android app and an iPhone app.

“We’ve recognised for the last 12 months the growth of smartphones in Ireland has been huge,” explained Robert Mulhall of AIB’s direct channel division. “We reckon that one out of every five of our 670,000 customers carry a smartphone.”

His colleague, Stephen Sherwin, of AIB’s internet banking channel, explained that the mobile banking service has been designed with security in mind but contains some nifty features.

“Because the mobile internet banking service integrates with the contacts list on the smartphone, a customer can easily top up the mobile credit of a family member, spouse or friend via their smartphone.”

AIB taking phased approach to mobile banking

Mulhall said the bank will be taking a phased approach to mobile. “We see smartphones as a ready market. The demand is there and we see how the profile is changing and how people are interacting online. Mobile is key. We’re keen to serve smartphone users. What we’ll be launching today in terms of functionality will be quite rich.

“We’ll start today with a mobile site on the browser but within a couple of weeks this will be followed by an Android app and within weeks of that an iPhone app.”

Sherwin said smartphone users will be able to use the mobile browser version of their AIB internet banking service to see all their balances, transactions on accounts and transfer funds between accounts, such as existing beneficiaries and existing bills.

“Effectively, the mobile site will be capable of 90pc of the functionality of the full internet site.

“We’re confident in terms of the security of the browser but we’re taking an extra step of only allowing transactions between pre-mandated bills or beneficiary accounts so that limits exposure if, for example, a smartphone was lost or stolen.

“If users need to add a new bill or beneficiary they can do so in the same way as they can with the internet banking by contacting the support centre for internet banking.”

IT delivery manager Paul Gardiner explained that the way the mobile banking site has been constructed, no data will be stored on the mobile device. “It’s all about accessibility. From a security perspective, we don’t envisage any issues. The mobile site has been customised to ensure visibility and allow customers to enjoy as many capabilities as they enjoy on the PC version of the banking site.

“It’s more optimised to suit the structure of the apps that we will be bringing out – to enable speedy banking from your mobile device. You can effectively top up credit for other mobile devices if you’re on a train, for example.”

Paving the way for NFC

I asked Mulhall if this will bring AIB in the direction of near field communications (NFC) and the ability to make contactless payments via chips contained in smartphones. Earlier this week, Google launched its NFC service Google Wallet in the US.

“Ultimately, that’s where this will go. We see this as the first step. The whole area of mobile payment is going to be huge. Users will be able to pass money to friends, family or colleagues by mobile phone. Commuter cards will be topped up via the mobile banking app, for example.

“Will this bring contactless payments via smartphones into the Irish market? Time will tell. There’s a whole suite of options that will be made possible if they use this channel,” Mulhall said.

“We’ve built this with an eye on the future, an eye on the future of banking.”