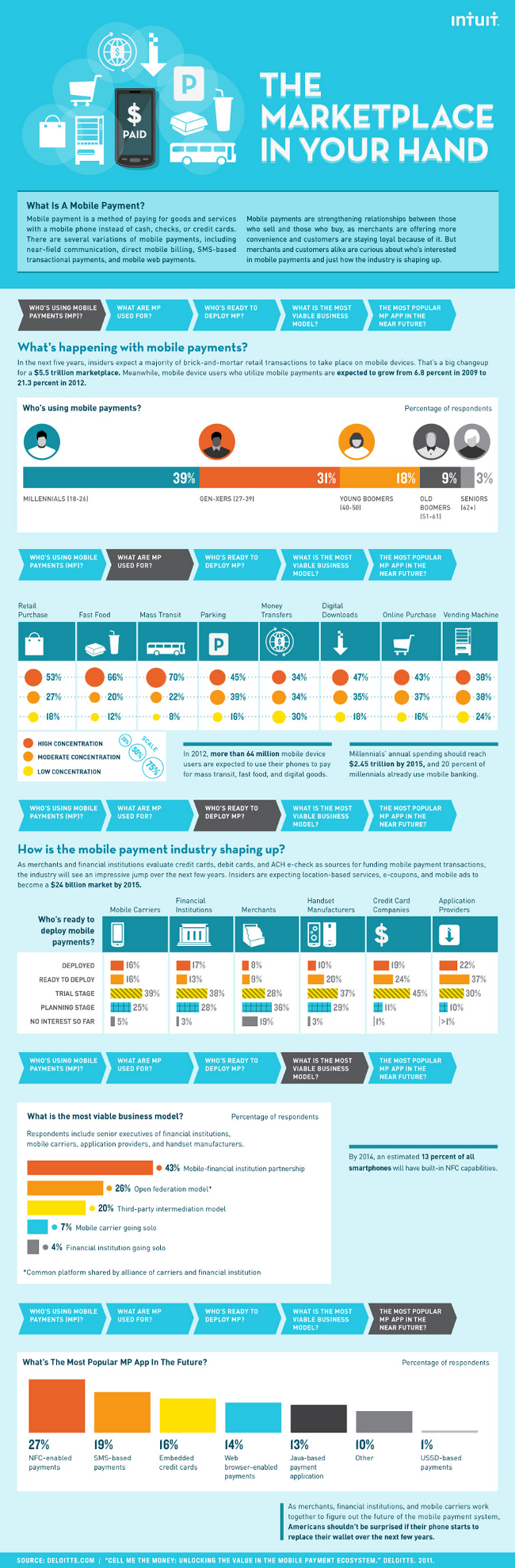

An infographic representing data from a Deloitte report on mobile payments looks at the marketplace and predicts significant growth over the coming years.

With the growth of the mobile web, mobile payments are becoming more commonplace. Just last week, the NFC-enabled Samsung Galaxy S III was named the official phone of the London 2012 Games. In a partnership with Visa, the phone can be used to make purchases at 140,000 contactless terminals around the UK.

‘The Marketplace in Your Hand’ infographic highlights information from ‘Cell Me the Money: Unlocking the value in the mobile payment ecosystem’, a 2011 report from Deloitte, to give an overview of the key players in the mobile payments marketplace – both consumers and businesses.

Convenience for consumers

Increased security and efficient tracking – not to mention the simplicity of making payments with a device most of us carry with us all the time – make mobile payments convenient and appealing to consumers, particularly those under the age of 40.

Mobile payments are being used for all sorts of transactions, from downloads and online shopping, to retail, fast food, transport, parking and even vending machine purchases. The percentage using mobile devices for payments is expected to reach to 21.3pc this year, more than tripling its 2009 figure of 6.8pc.

Mobile payments to take over in stores

As retailers adapt to accept this new payment method, mobile commerce will see significant growth. Over the next five years, the majority of retail transactions in bricks-and-mortar stores are expected to take place on mobile devices.

Merchants, mobile carriers, financial institutions, handset manufacturers, payment services and application providers all need to work together on this, and many of these are already trialling mobile payment systems, while others are either ready to deploy or already have implemented their systems. Merchants appear to be the most hesitant, with 19pc saying they have no interest in mobile payments so far, but this could change rapidly as the process become as common as sending a text message.

NFC-enabled payments are expected to be the most popular mobile payment app in the near future and it is estimated that 13pc of all smartphones will have built-in NFC capabilities by 2014. Before we know it, the obligatory last-minute check for ‘phone, wallet, keys’ before you leave the house may be whittled down to a twosome.