Bull market reflects increasing investor confidence

Microsoft, Hewlett-Packard, Fujitsu, US utility giant PG&E, Dutch telecommunications provider Royal KPN N.V are just some of the firms that have been dropped from the 2011 Dow Jones Sustainability Indexes (DJSI). Conversely, Xerox, Schneider Electric, Hyundai Mobis and healthcare firm Medtronic have made it onto the indexes for the first time.

In all 41 companies are being added to the Dow Jones Indexes, while 23 firms will be deleted from the DJSI World.

Dow Jones and SAM, the investment boutique that focuses on sustainability investing, compiled the 2011 Dow Jones Sustainability Indexes (DJSI).

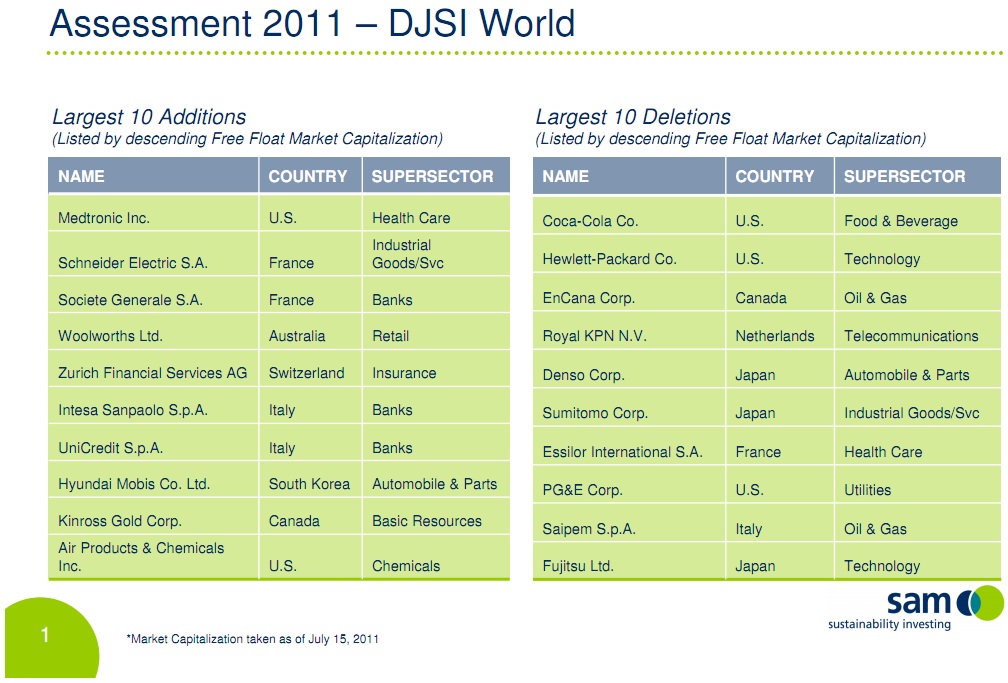

According to Dow Jones, the largest additions (by free-float market capitalisation) to the DJSI World include Medtronic Inc., Schneider Electric S.A. and Societe Generale S.A.

The largest deletions (by free-float market capitalisation) are Coca-Cola Co., Hewlett-Packard Co. and Encana Corp.

All changes are set to become effective when the stock markets open on 19 September 2011.

Tables courtesy of www.sustainability-index.com

Tech winners and losers on sustainability performance

In DJSI North America, the largest tech additions to the index there (by free-float market capitalisation) include EMC Corp., Sprint, Nextel Corp., Xerox Corp., and healthcare company Allergen.

DJSI North America

As part of the largest deletions from the North America index, Microsoft Corp. has been dropped as has beverage giant Coca-Cola and environmental company Waste Management Inc.

DJSI Europe

In DJSI Europe, the largest tech additions to the index there included Alcatel-Lucent and French utility giant Alstom. The largest deletions from the Europe list include Volkswagen AG Non-Vtg Pfd in Germany and STMicroelectronics N.V. in Italy. Norway’s Statoil has also been removed from the DJSI index for Europe.

DJSI Asia-Pacific

In DJSI Asia-Pacific, Japan’s NTT DoCoMo Inc. has been added to the index, as has the construction company Asahi Glass Co. Deletions from the Asia-Pacific index include Australia’s Telstra Corp, the Korean utility Korea Electric Power Corp and Japan’s healthcare firm Eisai Co.

Top percentile

In operation since 1999, the Dow Jones DJSI World and its respective subsets track the performance of the top 10pc of the 2,500 largest companies in the Dow Jones Global Total Stock Market Index (DJGTSM) that are ahead of the curve in terms of sustainability.

With about 60 licences, the DJSI have been linked to financial products in 16 countries, which DOW Jones and SAM say is an indication of investors’ increasing appetite to utilise the index as a means to reflect their sustainability convictions within their portfolios.

Creating long-term shareholder value

Dow Jones says a growing number of investors “perceive sustainability as a catalyst for enlightened and disciplined management, and, thus, a crucial success factor. As a result, investors are increasingly diversifying their portfolios by investing in companies that set industry-wide best practices with regard to sustainability.”

DJSI companies tracked daily

Once Dow Jones selects a company to be part of the DJSI, that company is monitored daily.

So what comes under the sustainability lens during the monitoring process and can result in company being struck off the list?

Dow Jones says it reviews the following issues:

- Commercial practices: ie, tax fraud, money laundering, antitrust, balance sheet fraud and corruption cases

- Human rights abuses: ie, cases involving discrimination, forced resettlements, child labour and discrimination of indigenous people

- Layoffs or workforce conflicts

- Catastrophic events or accidents: ie, fatalities, workplace safety issues, technical failures, ecological disasters and product recalls

Michael Baldinger, CEO, SAM, (pictured above) said that despite the global economic turmoil, it’s apparent that sustainability is still a high priority on corporate and investor agendas.

“Through the DJSI, we are pleased to provide access to a benchmark that offers investors exposure to sustainability leaders in each sector around the world, while also enabling them to create innovative passive and structured products,” explained Baldinger.

Meanwhile, Michael A. Petronella, president, Dow Jones Indexes (pictured above), pointed to how the DJSI has become the “gold standard” in pinpointing the world’s corporate sustainability leaders.

“These indexes have become an invaluable market tool for those seeking to support companies that are committed to creating and adopting sustainable business practices,” said Petronella.