While massive transactions like Facebook’s acquisition of WhatsApp are being given the mythological tag of unicorns (exits of more than US$1bn), close to two-thirds of tech exits came after the seed round or were ‘acqui-hires’ aimed at securing talent.

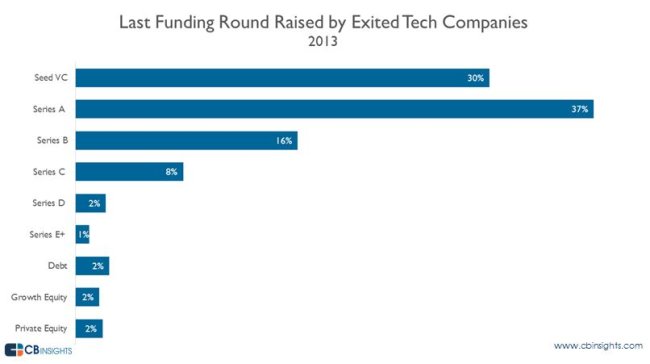

According to CB Insights data, 2013 saw 67pc of tech start-ups exit after either the seed or Series A stages.

It pointed out that while the headlines obsess about the WhatsApps and Twitters of the world, the reality is that most venture-backed start-up exits are smaller and far from being unicorns (tech companies that exit for more than US$1bn).

“While a portion of those went to acqui-hires of start-ups hitting the Series A crunch, the data is more likely a reflection of the venture capital power law, in which the best investments return more than the rest of the investments combined,” CB Insights said.

Unicorn image via Shutterstock